$35,000 as an annual retainer for their service on the Board. In addition, non-employee directors received additional retainers for the following roles:The Non-Executive Chairman received $125,000 per year;

The Chair of the Audit Committee received $25,000 per yearChair and $15,000 for each other member of the Audit Committee received $15,000 per year;Committee;

The Chair of•$27,000 for the Compensation Committee received $20,000 per yearChair and $12,000 for each other member of the Compensation Committee received $12,000 per year; andCommittee;

The Chair of•$20,000 for the Corporate Governance Committee received $15,000 per yearChair and $10,000 for each other member of the Corporate Governance Committee;

•$20,000 for the Risk Oversight Committee receivedChair and $10,000 per year.

The Chair of the Finance Committee received $15,000 per year andfor each other member of the FinanceRisk Oversight Committee; and

•$20,000 for the Corporate Social Responsibility and Public Policy Committee receivedChair and $10,000 per year.for each other member of the Corporate Social Responsibility and Public Policy Committee.

All directors are also reimbursed for reasonable expenses incurred in connection with service on the Board or any of its Committees.

Under the program, each non-employee director is automatically eligible for an annual equity award grantsgranted in the form of DSUsdeferred stock units (“DSU”) under the Director EquityConduent Incorporated 2021 Performance Incentive Plan. DSUs areA DSU is a bookkeeping entry that represents the right to receive one share of our Common Stock at a future date. DSUs are vested on the date of grant and include the right to receive dividend equivalents, which are credited in the form of additional DSUs, at the same time and in approximately the same amounts that the holder of an equivalent number of shares of our Common Stock would be entitled to receive in dividends. For 2017,2023, our non-employee directors received awere entitled to an annual grant of DSUs with a grant date fair value of $145,000.Changes$190,000. If a director separates from service prior to Director Compensation Program for 2018

On December 8, 2017, our Board adopted changes to the compensation program for our non-employee directors effective January 1, 2018. The program was modified as follows:

The grant date fair value of annualyear-end, DSU grants was increased from $145,000 to $190,000 to bring total pay in line with our peer group and emphasize equity in the mix of compensation.

DSU grants are subject to a mandatory holding period of one year following the grant date (previously one year following separation from service).

DSU agreements now include a clawback provision allowing for recovery of DSUs granted during the year of separation from service on a pro rata basis, if a director separates from service prior to year-end.basis.

Deferral of Retainer Fees

Board members can now elect to receive up to 100% of their $80,000 annual cash retainer, and/committee fees or annual equity grantother fees in the form of DSUs, the payout of which are deferred for a specified number of years following grant, as determined by the director, or until any earlier separation from service.

Director Stock Ownership Guidelines

In 2017, our Board established

The program includes stock ownership guidelines that require directors to own Common Stock in a minimum amount equal to 6 times the annual cash retainer ($80,000 x 6 = $480,000) within 3 years of adoption of the guidelines (or within 3 years of appointment to the Board for directors elected after 2017). Directors are required to holdretain 50% of all net after-tax shares received upon the vesting of Common equity awards (net of shares which may be sold to cover applicable taxes) until the threshold is achieved.

2023 Director Compensation Table

The following table shows the compensation paid by Conduent to its non-employee directors for the fiscal year ended December 31, 2023. Clifford Skelton, Chief Executive Officer, is not included in this table because he was an employee of the Company during 2023 and received no additional compensation for his service as a director. The compensation received by Mr. Skelton as an employee is included in the 2023 Summary Compensation Table below.

| | | | | | | | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | All Other Compensation ($) | Total ($) |

| Hunter Gary | 117,000 | | | 190,000 | — | 307,000 |

| Kathy Higgins Victor | 115,000 | | | 190,000 | — | 305,000 |

| Scott Letier | 227,000 | | (2) | 190,000 | — | 417,000 |

| Jesse Lynn | 100,000 | | | 190,000 | — | 290,000 |

| Steven Miller | 115,000 | | | 190,000 | — | 305,000 |

| Michael Montelongo | 135,000 | | | 190,000 | — | 325,000 |

| Margarita Paláu-Hernández | 112,000 | | (2) | 190,000 | — | 302,000 |

(1)This column reflects the aggregate grant date fair value of the annual equity grant made to non-employee directors in the form of DSUs ($190,000) and computed in accordance with Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) Topic 718, Compensation—Stock grantedCompensation.

(2)Directors elected to defer all or a portion of their annual cash retainer(s) and committee fees reflected in the Fees Earned or Paid in Cash column in the form of DSUs as follows: Mr. Letier: $227,000; and Margarita Paláu-Hernández: $112,000

The total number of all DSUs held by each director until compliance with the guidelines are met.as of December 31, 2023 is as follows: Mr. Gary: 40,861; Ms. Higgins Victor: 146,972; Mr. Letier: 309,312; Mr. Lynn: 74,490; Mr. Miller: 74,490; Mr. Montelongo: 80,527; and Ms. Paláu-Hernández: 164,468.

Security Ownership of

Company SecuritiesCertain Beneficial Owners (1)

We are not aware of any person who, or group which, owns beneficially more than 5% of any class of the Company’s equity securities

based on shares of Common Stock outstanding as of

December 31, 2017,March 18, 2024, except as set forth below.

| | | | | | | | | | |

| Title of Class | | Name and Address of Beneficial Owner | | Amount and

Nature of

Beneficial

Ownership | | | Percent

of Class | |

Common Stock | | FMR, LLC (2) 245 Summer St. Boston, MA 02210 | | | 23,289,802 | | | | 11.07 | % |

Common Stock | | Mr. Carl C. Icahn (3) c/o Icahn Capital LP 767 Fifth Avenue, 47th Floor New York, NY 10153 | | | 19,806,000 | | | | 9.8 | % |

Common Stock | | The Vanguard Group (4) 100 Vanguard Blvd. Malvern, PA 19355 | | | 17,298,502 | | | | 8.22 | % |

Common Stock | | Mr. Darwin A. Deason (5) 5956 Sherry Ln. Dallas, TX 75225 | | | 12,320,307 | | | | 5.86 | % |

(1) | The words “group” and “beneficial” are as defined in regulations issued by the SEC. Beneficial ownership under such definition means possession of sole voting power, shared voting power, sole dispositive power or shared dispositive power. The information provided in this table is based solely upon the information contained in the most recent Schedule 13G or 13G/A (or in the case of Mr. Icahn, the most recent Schedule 13D/A) filed by the named entity with the SEC. |

(2) | Based on a Schedule 13G filed with the SEC on March 12, 2018 by FMR LLC (“FMR”) to report FMR’s beneficial ownership of Common Stock as of February 28, 2018. FMR has sole voting power for 106,528 shares of Common Stock, sole dispositive power for 23,289,802 shares of Common Stock and has no shared voting power or shared dispositive power for any shares of Common Stock. Based on a Schedule 13G filed with the SEC on February 13, 2018 by FMR, FMR beneficially owned 14,262,330 shares of Common Stock (6.78%) as of December 31, 2017. |

(3) | Based on a Schedule 13D filed with the SEC on January 9, 2017 by Carl C. Icahn. |

| | | | | | | | | | | | | | | | |

| Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | | | | | |

| Common Stock | Mr. Carl C. Icahn (2)

c/o Icahn Capital LP

767 Fifth Avenue, 47th Floor

New York, NY 10153 | 38,149,336 | | 18.28 | % | | | | | |

| Common Stock | The Vanguard Group (3)

100 Vanguard Blvd.

Malvern, PA 19355 | 17,354,385 | | 8.32 | % | | | | | |

| Common Stock | Neuberger Berman Group LLC/Neuberger Berman Investment Advisers LLC (4)

1290 Avenue of the Americas

New York, NY 10104 | 14,693,141 | | 7.04 | % | | | | | |

| Common Stock | BlackRock, Inc. (5)

50 Hudson Yards

New York, NY 10001 | 14,650,070 | | 7.02 | % | | | | | |

| Common Stock | Mr. Darwin A. Deason (6)

3953 Maple Avenue, Suite 150

Dallas, TX 75219 | 12,320,307 | | 5.90 | % | | | | | |

| Common Stock | T. Rowe Price Investment Management, Inc. (7)

101 E. Pratt Street

Baltimore, MD 21201 | 10,906,621 | | 5.23 | % | | | | | |

____________________

(1)The words “group” and “beneficial” are as defined in regulations issued by the SEC. Beneficial ownership under such definition means possession of sole voting power, shared voting power, sole dispositive power or shared dispositive power. Other than Percent of Class, the information provided in this table is based solely upon the information contained in the most recent Schedule 13G or 13G/A (or in the case of Mr. Icahn and Mr. Deason, the most recent Schedule 13D or 13D/A) filed by the named entity with the SEC.

(2)Based on a Schedule 13D/A filed with the SEC on August 16, 2019 by Carl C. Icahn to report his beneficial ownership as of that date.

Represents shares of Common Stock held by the following group of entities associated with Carl C. Icahn: High River Limited Partnership (“High River”), Hopper Investments LLC (“Hopper”), Barberry Corp. (“Barberry”), Icahn Partners Master Fund LP (“Icahn Master”), Icahn Offshore LP (“Icahn Offshore”), Icahn Partners LP (“Icahn Partners”), Icahn Onshore LP (“Icahn Onshore”), Icahn Capital LP (“Icahn Capital”), IPH GP LLC (“IPH”IPH”), Icahn Enterprises Holdings L.P. (“Icahn Enterprises Holdings”), Icahn Enterprises G.P. Inc. (“Icahn Enterprises GP”) and Beckton Corp. (“Beckton”)(collectively, (collectively, the “Reporting Persons”). The principal business address of (i) each of High River, Hopper, Barberry, Icahn Offshore, Icahn Partners, Icahn Master, Icahn Onshore, Icahn Capital, IPH, Icahn Enterprises Holdings, Icahn Enterprises GP and Becktonthe Reporting Persons is White Plains Plaza, 445 Hamilton Avenue - Suite 1210, White Plains, NY 10601, and (ii) Mr. Icahn is c/o Icahn Associates Holding LLC, 767 Fifth Avenue, 47th Floor, New York, NY 10153. High River has sole voting power and sole dispositive power with regard to 3,961,2007,629,868 shares of Common Stock. Each of Hopper, Barberry and Mr. Icahn has shared voting power and shared dispositive power with regard to such shares of Common Stock. Icahn Master has sole voting power and sole dispositive power with regard to 6,563,01812,672,483 shares of Common Stock. Each of Icahn Offshore, Icahn Capital, IPH, Icahn Enterprises Holdings, Icahn Enterprises GP, Beckton and Mr. Icahn has shared voting power and shared dispositive power with regard to such shares of Common Stock. Icahn Partners has sole voting

power and

sole dispositive power with regard to 9,281,78217,846,985 shares of Common Stock. Each of Icahn Onshore, Icahn Capital, IPH, Icahn Enterprises Holdings, Icahn Enterprises GP, Beckton and Mr. Icahn has shared voting power and shared dispositive power with regard to such shares of Common Stock.

Each of Hopper, Barberry and Mr. Icahn, by virtue of their relationships to High River, may be deemed to indirectly beneficially own the shares of Common Stock which High River directly beneficially owns. Each of Hopper, Barberry and Mr. Icahn disclaims beneficial ownership of such shares of Common Stock for all other purposes. Each of Icahn Offshore, Icahn Capital, IPH, Icahn Enterprises Holdings, Icahn Enterprises GP, Beckton and Mr. Icahn, by virtue of their relationships to Icahn Master, may be deemed to indirectly beneficially own the shares of Common Stock which Icahn Master directly beneficially owns. Each of Icahn Offshore, Icahn Capital, IPH, Icahn Enterprises Holdings, Icahn Enterprises GP, Beckton and Mr. Icahn disclaims beneficial ownership of such shares of Common Stock for all other purposes. Each of Icahn Onshore, Icahn Capital, IPH, Icahn Enterprises Holdings, Icahn Enterprises GP, Beckton and Mr. Icahn, by virtue of their relationships to Icahn Partners, may be deemed to indirectly beneficially own the shares of Common Stock which Icahn Partners directly beneficially owns. Each of Icahn Onshore, Icahn Capital, IPH, Icahn Enterprises Holdings, Icahn Enterprises GP, Beckton and Mr. Icahn disclaims beneficial ownership of such shares of Common Stock for all other purposes.

(4) | Based on a Schedule 13G filed with the SEC on February 8, 2018 by The Vanguard Group (“Vanguard”). Vanguard has sole voting power for 101,325 shares of Common Stock, sole dispositive power for 17,186,965 shares of Common Stock, shared voting power for 23,520 shares of Common Stock and shared dispositive power for 111,537 shares of Common Stock. |

(5) | Based on a Schedule 13G filed with the SEC on February 12, 2018 by Darwin A. Deason. Mr. Deason has sole voting power and sole dispositive power for 12,320,307 shares of Common Stock and has no shared voting power or shared dispositive power for any shares of Common Stock. Mr. Deason’s shares of Common Stock includes 5,393,256 shares of Common Stock issuable upon the conversion of 120,000 shares of Conduent Series A Convertible Perpetual Preferred Stock that he holds. |

(3)Based on a Schedule 13G/A filed with the SEC on February 13, 2024 by The Vanguard Group (“Vanguard”), Vanguard has no sole voting power for any shares of Common Stock, sole dispositive power for 17,020,002 shares of Common Stock, shared voting power for 192,116 shares of Common Stock and shared dispositive power for 334,383 shares of Common Stock.

(4)Based on a Schedule 13G/A filed with the SEC on February 12, 2024 by Neuberger Berman Group LLC and Neuberger Berman Investment Advisers LLC (together “Neuberger”), Neuberger has no sole voting power or sole dispositive power for any shares of Common Stock, shared voting power for 12,290,280 shares of Common Stock and shared dispositive power for 14,693,141 shares of Common Stock.

(5)Based on a Schedule 13G/A filed with the SEC on January 26, 2024 by BlackRock, Inc. (“BlackRock”), BlackRock has sole voting power for 14,061,414 shares of Common Stock, sole dispositive power for 14,650,070 shares of Common Stock and has no shared voting power or shared dispositive power for any shares of Common Stock.

(6)Based on a Schedule 13D/A filed with the SEC on February 16, 2021 by Darwin A. Deason. Mr. Deason has sole voting power and sole dispositive power for 12,320,307 shares of Common Stock and has no shared voting power or shared dispositive power for any shares of Common Stock, which shares include 5,393,256 shares of Common Stock issuable upon the conversion of 120,000 shares of Conduent Series A Convertible Perpetual Preferred Stock held by Mr. Deason.

(7)Based on a Schedule 13G filed with the SEC on February 14, 2024 by T. Rowe Price Investment Management, Inc. (“T. Rowe Price”), T. Rowe Price has sole voting power for 3,961,000 shares of Common Stock, sole dispositive power for 10,906,621 shares of Common Stock and has no shared voting power or shared dispositive power for any shares of Common Stock.

Shares of Common Stock of the Company owned beneficially by the directors and nominees for director, each of the

currentnamed executive officers named in the Summary Compensation Table and all

current directors and

current executive officers as a group, as of

February 28, 2018,March 18, 2024, were as follows.

TheseTo our knowledge, these individuals have sole voting and dispositive power with respect to the reported shares.

| | | | | |

Name of

Beneficial Owner | | Amount

Beneficially

Owned (1)(2)(3) |

Name of

Beneficial OwnerClifford Skelton, President and Chief Executive Officer | 1,788,087 | | Amount

Beneficially

Owned

Ashok Vemuri

Louis Keyes, Executive Vice President, Chief Revenue Officer | 292,931 | | 239,161

David Amoriell

Randall King, Executive Vice President, Commercial Solutions | 144,216 | | 107,798

Jeffrey Friedel

Michael Krawitz, Executive Vice President, General Counsel and Secretary | 562,121 | | 85,112

Paul Galant

Mark Prout, Executive Vice President, Chief Information Officer | 297,038 | | 20,984

Nicholas Graziano

Stephen Wood, Executive Vice President, Chief Financial Officer | 271,436 | | 0

JoieMark King, former Executive Vice President, Government Solutions

| 53,190 | |

| Hunter Gary, Director | 94,407 | |

| Kathy Higgins Victor, Director | 12,708 | |

| Scott Letier, Director | 132,251 | |

Jesse A. GregorLynn, Director | 83,633 | | 20,984

Vincent J. Intrieri

Steven Miller, Director | 34,151 | | 20,984

Courtney Mather

Michael Montelongo, Director | 90,431 | | 23,362

Michael Nevin

Margarita Paláu-Hernández, Director | 45,524 | | 20,984

Michael A. Nutter

| | 20,984

|

William G. Parrett

| | 23,362

|

J. Michael Peffer

| | 98,313

|

Brian Webb-Walsh

| | 102,930

|

Virginia M. Wilson

| | 20,984

|

All current directors and executive officers as a group (15) (13 total) | 3,848,934 | | 813,795

(1)Percent Owned by all Current Directors and Executive Officers: Each current director and executive officer beneficially ownedowns less than 1% of the aggregate number of shares of Common Stock outstanding as of February 28, 2018.March 18, 2024. The amount beneficially owned by all current directors and executive officers as a group also amounted to less than 1%was 1.84%.

(2)Amount Beneficially Owned: The numbers shown above are the shares of Common Stock considered beneficially owned by the directors and executive officers in accordance with SEC rules and includes shares held indirectly, such as shares held in a grantor retained annuity trust or by family members.indirectly.

(3)Shares of Common Stock which executive officers, directors and nominees have a right, within 60 days of February 28, 2018,March 18, 2024, to acquire upon the exercise of options or rights or upon vesting of performance shares, DSUs or restricted stock units are also required to be included for purposes of determining beneficial ownership. None of our executive officers, directors or nominees hold any Company securities which are exercisable or scheduled to vest within 60 days of February 28, 2018 with the exception of DSUs.March 18, 2024.

Section 16(a)

Beneficial Ownership Reporting ComplianceReports

Section 16(a) of the Exchange Act (“Section 16”) requires the Company’s directors, executive officers and persons who own more than ten percent of the Common Stock of the Company, to file with the SEC initial reports of beneficial ownership and reports of changes in beneficial ownership of Common Stock of the Company. Based solely on review of these reports, or written representations from these persons that no other reports were required to be filed with the SEC, the Company believes that all reports for the Company’s directors, and executive officers and ten percent shareholders that were required to be filed under Section 16 during the fiscal year ended December 31, 20172023 were timely filed.

COMPENSATION DISCUSSION AND ANALYSIS

EXECUTIVE SUMMARY

2017 Business Highlights

2017 Financial Achievements

Revenue of $6,022 million, in line with guidance

Net income from continuing operations of $177 million

Adjusted net income of $186 million

Adjusted EBITDA of $672 million, up 6% year-over-year

$302 million of cash flow from operationsIn this Compensation Discussion and $204 million of free cash flow (adjusted for cash payments to deferredAnalysis (“CD&A”), we discuss the compensation plan participants)

2017 Operational Achievements

Overachieved 2017 strategic transformation goals

Established the Conduent brandphilosophy, programs and a clear go-to-market strategy

Expanded our salesforce and client partners to better meet the needs of our clients

Invested in platforms, technology and infrastructure

Summary of 2017 Actions

Linking Pay with Performance

2017 marked our first year of operations as Conduent. As a new Company,practices adopted by the Compensation Committee made several decisions regardingof the compensationBoard of Directors of Conduent (the “

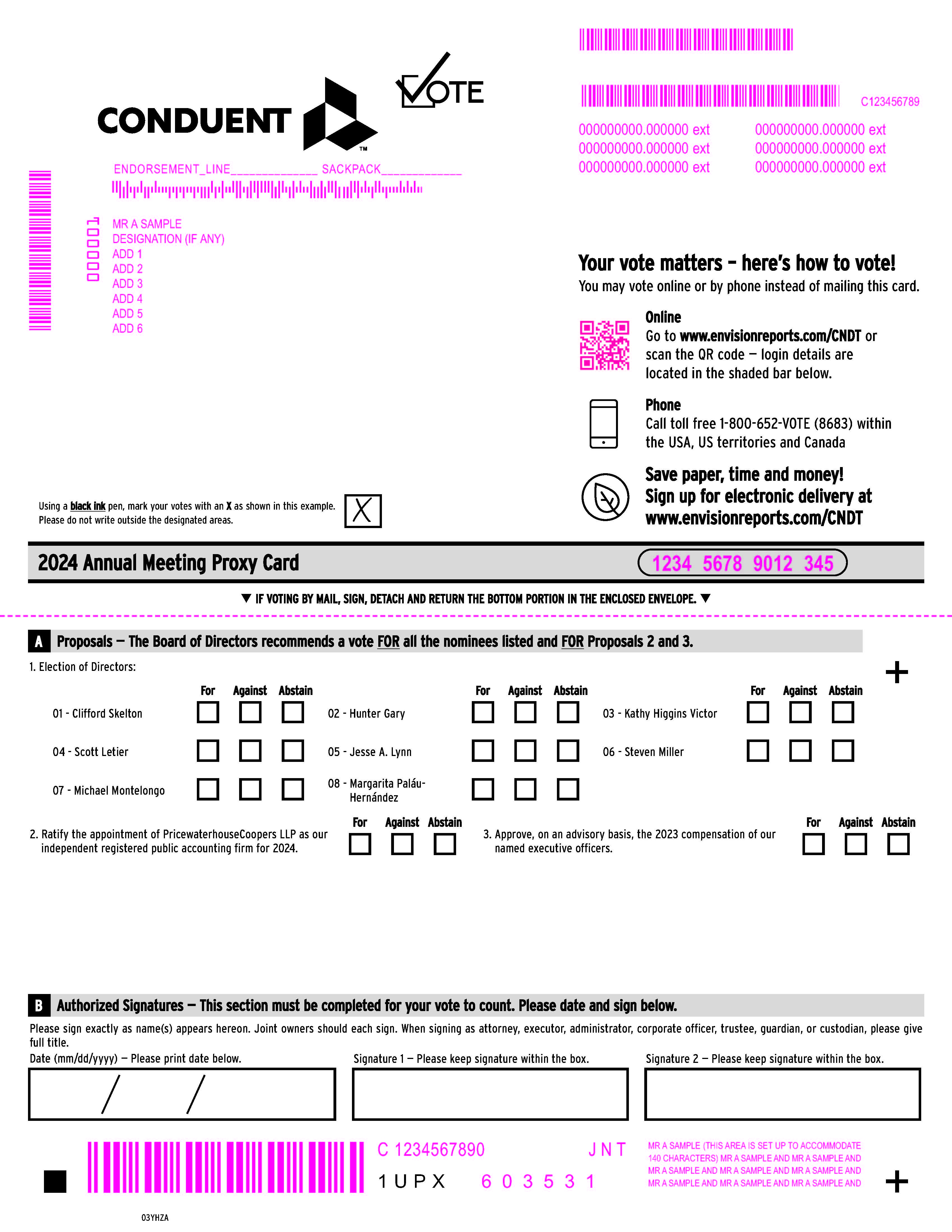

Compensation Committee”) for our named executive officers and review the various objectives and elements of our executive compensation program, its alignment with performance and the 2023 compensation decisions regarding our named executive officers. For purposes of this CD&A and the disclosure that follows, the following are our named executive officers for 2023:

•Clifford Skelton, President and Chief Executive Officer;

•Stephen Wood, Executive Vice President and Chief Financial Officer;

•Michael Krawitz, Executive Vice President, General Counsel and Secretary;

•Mark Prout, Executive Vice President, Chief Information Officer;

•Randall King, Executive Vice President, Commercial Solutions; and

•Mark King(1), Former Executive Vice President, Government Solutions.

(1)Although Mark King is a named executive officer for 2023, on December 15, 2023, Mark King ceased being an Executive Officer of Conduent and on January 2, 2024, Mark King voluntarily terminated his employment with Conduent, and thus is no longer an active associate.

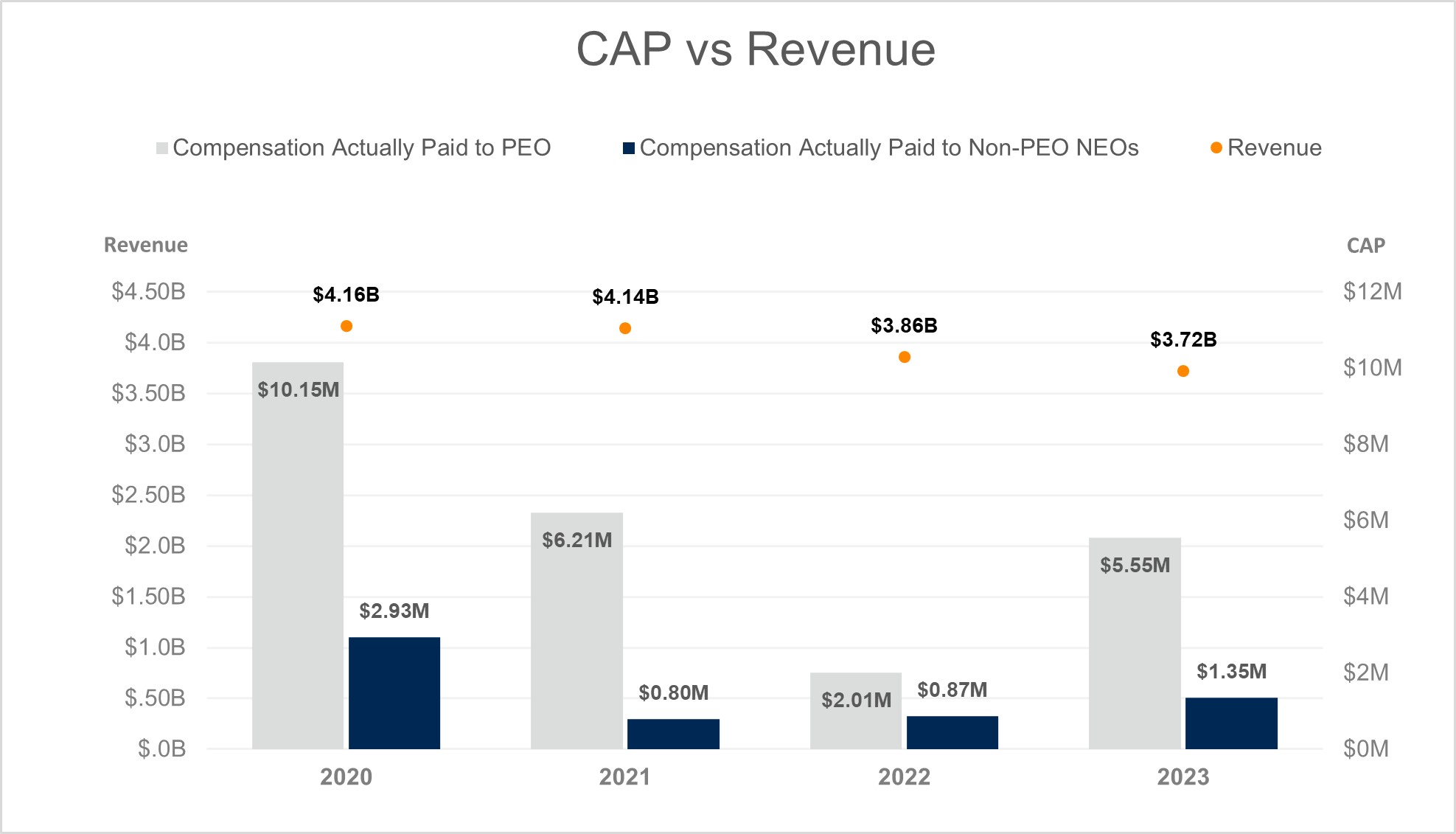

Executive Summary

With revenues of approximately $3.7 billion, we deliver digital business solutions and services spanning the commercial, government and transportation spectrum – creating valuable outcomes for our clients and the millions of people who count on them. The Company leverages cloud computing, artificial intelligence ("AI"), machine learning, automation and advanced analytics to deliver mission-critical business process solutions. Through a dedicated global team of associates, process expertise, and advanced technologies, Conduent’s solutions and services digitally transform its clients’ operations to enhance customer experiences, improve performance, increase efficiencies and reduce costs. Our goal is to be the technology-led business solutions partner of choice for businesses and governments globally. To achieve this, we focus on three critical dimensions across our Company: Growth, Efficiency and Quality. Our strategy is designed to deliver shareholder value by driving profitable growth, expanding operating margins, implementing process efficiencies, and employing a disciplined portfolio rationalization and capital allocation strategy.

Our strategic focus on Growth, Efficiency and Quality serves as the foundation for our compensation programs. Key aspects of our compensation program design are directly aligned to our strategic focus, including incentivizing revenue growth and operational efficiency, and creating sustainable shareholder value. To this end, our compensation program links pay to performance, aligns to our shareholder interests, and is reflective of our 2023 operational and financial results.

Growth: Our opportunity for growth comes from understanding our clients’ businesses and driving valuable outcomes for our clients to help them reduce costs, improve efficiency and performance, and elevate customer experiences.

Our annual compensation bonus plan rewards achievement for success in 2017.Growth by including Adjusted Revenue and Net Annual Recurring Revenue (“ARR”) Activity metrics. Our long-term incentive plans also reward Growth, as our performance restricted stock awards have metrics tied to our total shareholder return against our proxy peers and revenue growth.

Efficiency: We continue to identify ways to reduce costs and deliver solutions more efficiently.

Our compensation plans reward success in Efficiency by measuring improvement in adjusted earnings before interest, taxes, depreciation, and amortization (“Adjusted EBITDA”) margin. (Please refer to “Definitions” and “Non-GAAP Financial Measures”.)

Quality: Our clients count on stable, high-quality service delivery. We focus on continuous improvement in system uptime and operational stability. Our focus on Quality has resulted in client confidence and satisfaction.

Delivering with high quality impacts revenue and Adjusted EBITDA margins and thus is an important additional factor when determining annual incentive plan payouts.

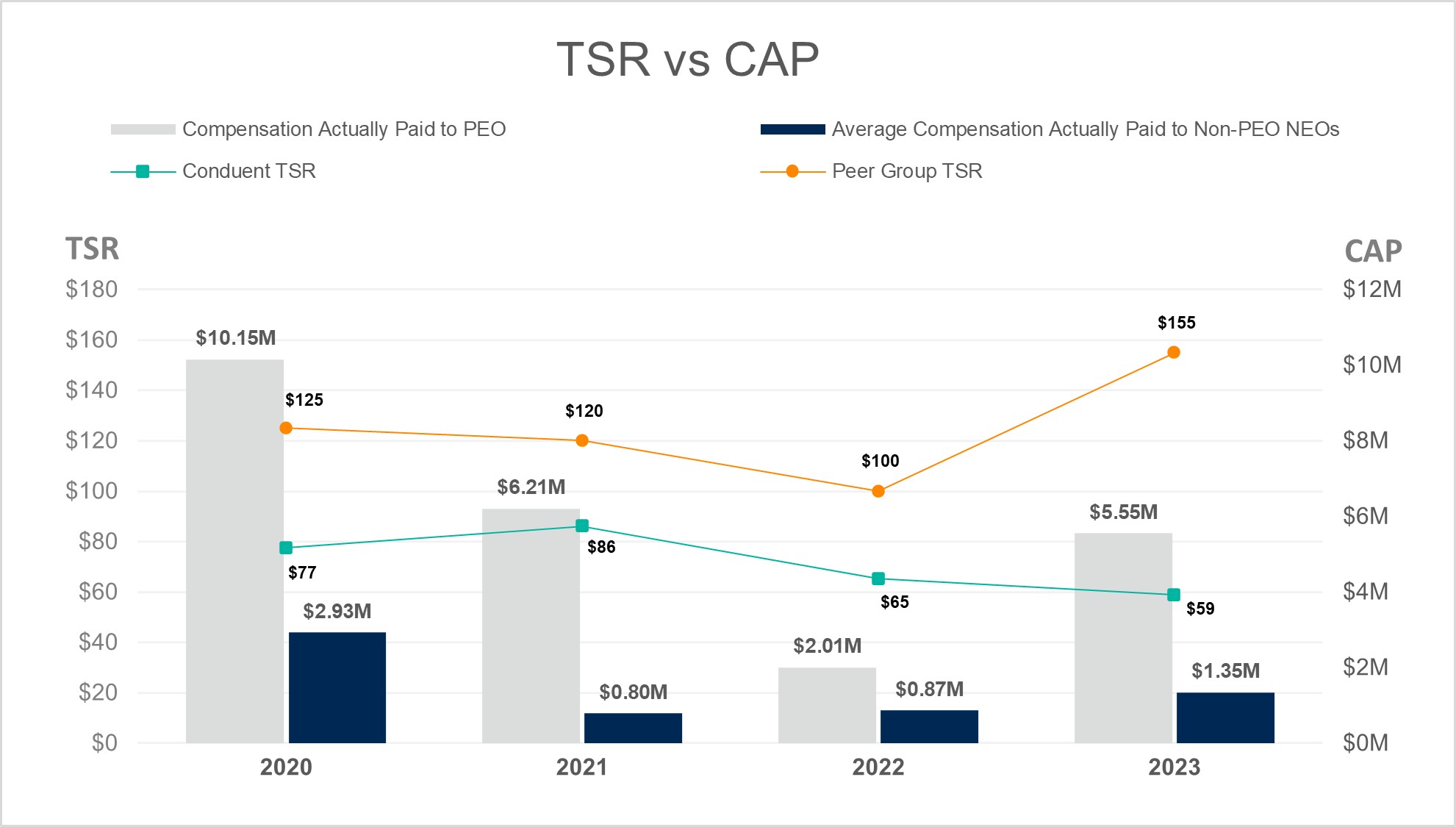

2023 Performance

Adjusted Revenue, Adjusted EBITDA and Adjusted EBITDA Margin for 2023 were within our original full-year 2023 guided range. Our Total Contract Value sales were up 20% year over year, and our new business pipeline remains up 10% year over year. However, we experienced some macroeconomic headwinds in our Commercial sales efforts, which contributed to our Net ARR metric ending the year below our expected target. In March 2023, we outlined a game plan for growth, rationalization, and improved cash flow generation with a target 2025 exit plan. We concluded year one of that plan with two portfolio divestiture announcements, expected to close in the first half of 2024. Our 2023 APIP funding results are a reflection of Conduent’s financial and operating results achieved throughout the year.

Annual Performance Incentive Plan (“APIP”) Results

The performance measures and weightings in the 2023 APIP were Adjusted Revenue (weighted 40%), Adjusted EBITDA Margin(1) (weighted 40%) and Net ARR Activity (weighted 20%). Our 2023 financial results led to a 51% of target funding for our APIP.

The 2023 Adjusted Revenue, Adjusted EBITDA Margin and Net ARR Activity metric performance goals were established in March 2023. The Compensation

PhilosophyCommittee did not reset these goals or make upward adjustments in determining overall APIP Funding.

(1)Please see “Non-GAAP Financial Measures” beginning on page 51 of this Proxy Statement for information on our non-GAAP financial measures.

Long-Term Incentive Plan (“LTIP”) Results

2023 LTIP

Our 2023 LTIP grant consisted of time-based restricted stock units (“RSUs”) with respect to 50% of the grant, vesting ratably over a three-year period; and performance-based restricted stock units (“PRSUs”) with respect to 50% of the grant, of which 70% percent are based on revenue growth (“2023 PRSU—Revenue Growth”) and 30% are based on relative Total Shareholder Return (“2023 PRSU—rTSR”) each over a three-year period. The 2023 PRSU—rTSR is based on Conduent’s three-year total shareholder return relative to our August 2022-2023 compensation peers, and the PRSU—Revenue Growth is based on our average annual revenue growth for the three-year period. The 2023 LTIP grant balances the need to increase revenues to drive shareholder value, while fostering participant retention and stock ownership.

2022 LTIP

Our 2022 LTIP grant consisted of time-based RSUs with respect to 50% of the grant, vesting ratably over a three-year period, and PRSUs with respect to 50% of the grant, vesting over a three-year period. The 2022 PRSUs are tied to our share price appreciation (“2022 PRSU—Share Hurdle”) with a relative Total Shareholder Return (“rTSR”) modifier of up to plus or minus 5%, based on Conduent’s total shareholder return relative to our August 2021-2022 compensation peers.

As of December 31, 2023, the 2022 PRSU—Share Hurdle awards have not been earned as none of the share hurdles have been met. These awards, however, remain outstanding and may be earned for active associates if the share price appreciation metrics are met by December 31, 2024. Conduent’s relative total shareholder return from January 1, 2023 through December 31, 2023 resulted in an rTSR modifier of -5% for tranche two. As a result, if the share hurdle for the second tranche of the 2022 PRSU—Share Hurdle award is achieved, the granted shares will be adjusted to 95.00% of the original shares granted. The rTSR modifier for the first tranche of the award is -4.29%. As a result, if the share hurdle for the first tranche of the 2022 PRSU—Share Hurdle award is achieved, the granted shares will be adjusted to 95.71% of the original shares granted.

2021 LTIP

Our 2021 LTIP grant included time-based RSUs, weighted 50%, vesting ratably over a three-year period, and two types of PRSUs, each weighted 25%, and also vesting over a three-year period. The first PRSU type was tied to our share price appreciation (“2021 PRSU—Share Hurdle”). The second PRSU type (“2021 PRSU—Revenue Hurdle”) was tied to annual revenue growth with an Adjusted EBITDA margin threshold.

As of December 31, 2023, none of the 2021 PRSU—Share Hurdle awards had been earned and thus, all tranches were forfeited.

Additionally, the third and final tranche of the 2021 PRSU—Revenue Hurdle awards did not vest on December 31, 2023, as neither our revenue growth target for 2023 nor our Adjusted EBITDA margin threshold were met.

The Compensation Committee certified these results on February 1, 2024, and as a result, the third tranche of the 2021 PRSU—Revenue Hurdle shares was forfeited.

Advisory Say on Pay Vote and Shareholder Engagement

Our executive compensation is subject to an annual advisory vote of shareholders at our Annual Meeting. The Compensation Committee considers the outcome of Say on Pay votes when making compensation decisions for our named executive officers. At the 2023 Annual Meeting of Shareholders, 96.8% of shares voted were in favor of our executive compensation program, demonstrating strong shareholder support. Our Board and the Compensation Committee greatly value the benefits of maintaining a dialogue with our shareholders and understanding their views. Our management team established and participated in various shareholder engagement activities in 2023. Our investor relations function proactively engages with our shareholders to provide updates on the performance of the Company and solicit feedback on various topics.

Executive Compensation Programs areProgram

Compensation Philosophy

Our executive compensation program is designed to attract, motivate, reward and retain

the world classtop talent necessary to drive our business strategy

creatingand create shareholder value. Our programs are designed to follow these principles:

•provide competitive compensation to attract and retain executives critical to our long-term success;

•align executive and shareholder interests through the use ofusing both short-term and long-term financial and strategic objectives that build a sustainable Company;company;

•recognize and reward collective accountability and individual contribution to ensuredrive enterprise results;

•instill high standards of corporate governance and best practices; and

•mitigate excess risk taking and/or behavior that is inconsistent with the Company’s strategic plans and high ethical standards.

Checklist of Compensation Practices

| | | | | | | | | | | |

| |

| What We Do | | What We Don’t Do |

✓ | | Deliver a significant portion of compensation through long-term incentives tied directly to shareholder value creation. | X | X | | Permit re-pricing of underwater stock options.options or springloading of equity grants. |

✓ | | Balance short- and long-term incentives with multiple performance metrics. | X | X | | Provide a defined-benefit pension plan or SERPs to executives (only all-employee 401(k) plan). |

✓ | Impose caps on our annual incentive and PRSU awards for our named executive officers. | X | Provide special executive perquisites or excessive termination payments. |

| ✓ | Maintain pay-recoupmenta recoupment policy that allows claw backclawback of cash and equity compensation earned as a resultbecause of fraudulent or illegal conduct.conduct or in the event of an accounting restatement. | X | X | | Provide excessive perquisitesAllow directors, named executive officers and other senior leaders to hedge or termination payments.pledge Company stock. |

✓ | | Maintain stock ownership requirements for all of our named executive officers. | X | X | | Allow hedgingPermit tax gross-ups on change in control or pledging of Company stock.other severance payments. |

✓ | | Conduct an annual review of programs to ensure they do not encourage risks that have a material adverse effect on the Company. | X | X | | Permit gross-ups on change in control or other severance paymentsMaintain written employment contracts with our executive officers. |

✓ | | Maintain non-competition and non-solicitation agreements with our named executive officers that prohibit competing against Conduent and soliciting our customers or current employeesassociates after termination.termination, to the extent legally permitted. | X | X | | Maintain written contracts with our executive officers (other than the Chief Executive Officer) that provide special benefits.Allow single-trigger change in control arrangements. |

✓ | | EmployEngage an Independent Consultant under the direction of the Compensation Committee. | X | X | | Allow single-trigger vesting change in control arrangements.Provide guaranteed incentive payouts for named executive officers. |

2023 Total Direct Compensation Targets for Named Executive Officers

The Compensation Committee approved the annual target total direct compensation levels for all Executive Officers, focusing on the key elements of compensation—active named executive officers for 2023. The table below illustrates annual base salary, target short-term incentive and target long-term equity-based incentive for each named executive officer as of December 31, 2023.

| | | | | | | | | | | | | | | | | |

| Executive | Title | Annual Base

Salary | Target Short-

Term Incentive

(% of Base

Salary) | Target Long-

Term Incentive | Target Total

Direct

Compensation |

| Clifford Skelton | President and Chief Executive Officer | $835,000 | 150 | % | $5,000,000 | $7,087,500 |

| Stephen Wood | Executive Vice President and Chief Financial Officer | $525,000 | 80 | % | $1,150,000 | $2,095,000 |

| Michael Krawitz | Executive Vice President, General Counsel & Secretary | $500,000 | 75 | % | $1,000,000 | $1,875,000 |

| Mark Prout | Executive Vice President, Chief Information Officer | $450,000 | 75 | % | $750,000 | $1,537,500 |

| Randall King | Executive Vice President, Commercial Solutions | $450,000 | 75 | % | $600,000 | $1,387,500 |

| Mark King | Executive Vice President, Government Solutions (Former) | $450,000 | 75 | % | $800,000 | $1,587,500 |

To adjust target compensation levels to be closer to market levels and to our peers, the table above reflects the following changes made during 2023:

•Mr. Clifford Skelton received a long-term incentive increase from $4,250,000 to $5,000,000

•Mr. Mark King received a base salary increase from $425,000 to $450,000 effective February 2, 2023, and a long-term incentive target increase from $500,000 to $800,000.

•Mr. Randall King received an increase in target long-term incentive from $500,000 to $600,000

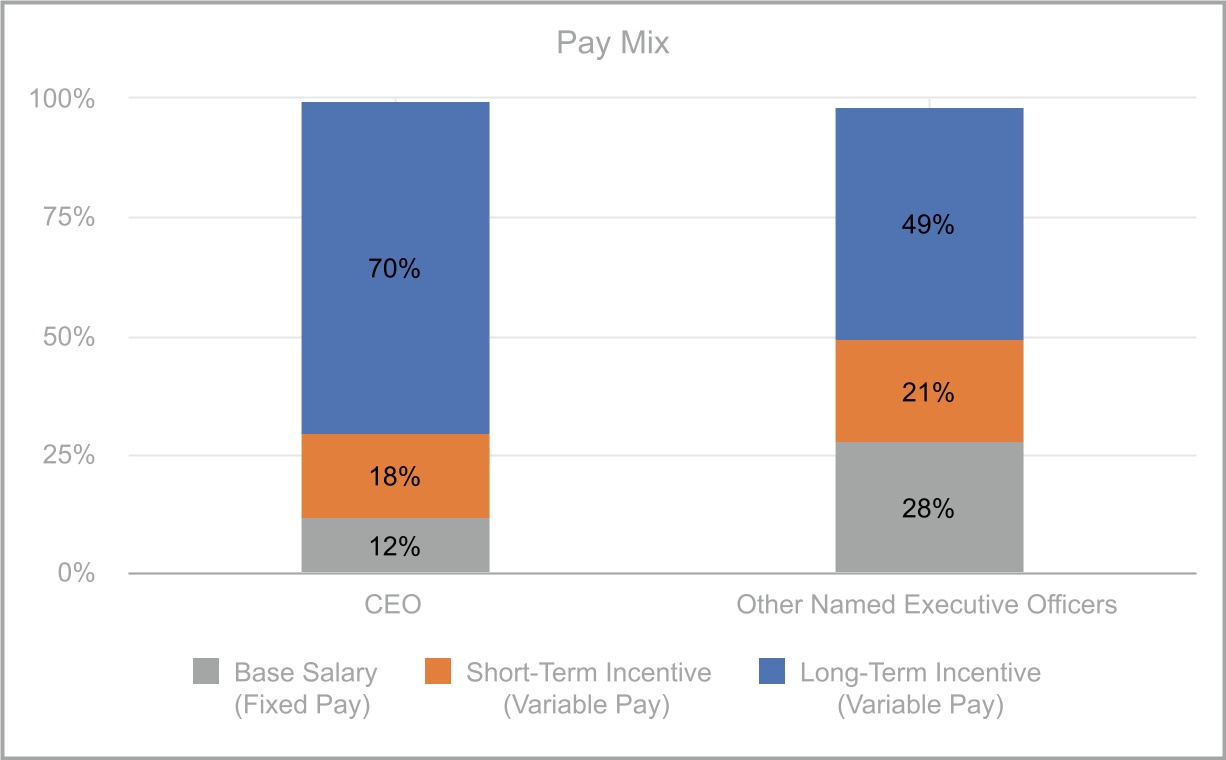

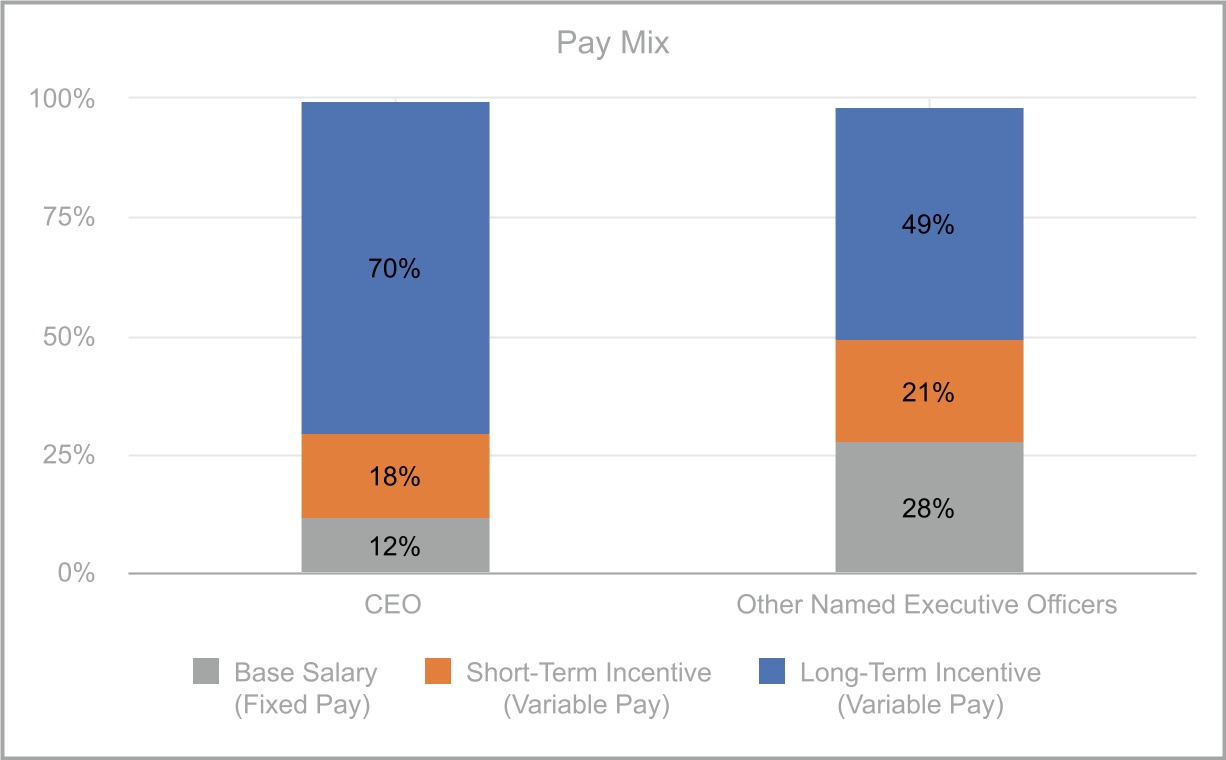

The chart below reflects the 2023 annual

performance bonus and long-term equity incentives. To re-inforce the Company’s pay for performance philosophy, 53% of targetedtarget total direct compensation

pay mix for our

Chief Executive OfficerCEO and

on average, 46% for our other named executive officers

is performance-based. | | | | | | | | | | | | | | |

| Executive | | Title | | Base

Salary | | | Target Short-

Term Incentive

(% of Salary) | | | Target Long-

Term Incentive

(Grant Date

Value on 4/1/17) | |

Ashok Vemuri | | Chief Executive Officer (CEO) | | $ | 1,000,000 | | | | 150 | % | | $ | 5,000,000 | |

Brian Webb-Walsh | | Executive Vice President and Chief Financial Officer (CFO) | | $ | 450,000 | | | | 75 | % | | $ | 975,000 | |

Dave Amoriell | | President | | $ | 536,000 | | | | 75 | % | | $ | 800,000 | |

J. Michael Peffer | | Executive Vice President, General Counsel and Secretary | | $ | 500,000 | | | | 75 | % | | $ | 800,000 | |

Jeffrey Friedel | | Executive Vice President, Chief People Officer | | $ | 425,000 | | | | 75 | % | | $ | 500,000 | |

This table does not reflect the Strategic Initiative Grants described below that were awarded to eachas of the named executive officers. Additional information can be found under “Strategic Initiative Grants” on page 31.

The charts below reflect the 2017 pay mix for our named executive officersDecember 31, 2023, and the portion of their targeted total direct compensation that is variable pay. Basing this variable compensation upon financialperformance results, and share priceincluding Conduent’s rTSR performance as compared to our proxy peers, directly aligns our executivesexecutives’ interests with shareholder value creation.

| | |

|

| |

CEO - Pay Mix | | All Other Named Executive Officers – Pay Mix |

Performance-based Incentives

Short-Term Incentives

All To reinforce the Company’s pay for performance philosophy, 88% of our CEO’s targeted total direct compensation, and on average 70% for our other named executive officers, participated in the Annual Performance Incentive Program (“APIPis variable and “at risk.”) which focused on the business priorities

Process for 2017. The 2017 performance measures and weightings for APIP were: Adjusted EBITDA (60%), Revenue Growth (at constant currency) (30%) and Revenue Productivity (per employee) (10%). Adjusted EBITDA represents income (loss) before interest, income taxes, depreciation and amortization adjusted for Restructuring and related costs, Separation costs, Other (income) expenses, net, the NY Medicaid Management Information System (NY MMIS), Health Enterprise charge (HE charge) and (Gain) loss on sale of asset and business. Revenue Growth is measured at constant currency and excludes the impact of changes in the translation of foreign currencies into U.S. Dollars. Revenue Productivity measures how efficiently the Company utilized its employees, supported by the cost reduction initiatives and the move towards automation. Results for the measure were evaluated based on the revenue from all business units, divided by total headcount (excluding corporate and contingent workers), and averaged each quarter.Determining Compensation

Additional information regarding short-term incentives can be found under “2017 Compensation for the Named Executive Officers—Short-Term Incentives.”

Long-Term Incentives

In early 2017, the Compensation Committee reviewed peer group data and approved an Executive Long-Term Incentive Program (“ELTIP”) that aligned with the interests of shareholders and the Company. The 2017 ELTIP includes a mix of 50% performance based awards (performance shares) and 50% time based awards (restricted shares). This approach balances the need to motivate and drive future behavior while being retentive and fostering stock ownership. Performance shares are measured over three years. Performance for each year is measured against pre-established annual goals and the subsequent payout is averaged over the three year performance period (2017 through 2019). Vesting occurs at the end of the three-year performance period. Restricted shares are subject to three-year ratable vesting (one-third on 12/31/17, 12/31/18 and 12/31/19 respectively).

The Compensation Committee approved ELTIP awards with a grant date of April 1, 2017. Officers participated at their individual ELTIP target level. The 2017 performance measures and weightings are as follows: Adjusted Profit Before Tax (PBT) (50%) and Free Cash Flow (50%). Adjusted Profit Before Tax is defined as income or loss before Income Taxes as reported on the Consolidated statement of Income (Loss), less amortization of intangible assets; restructuring and related costs; Separation costs; other expenses net, including losses (gains) on sales of businesses and assets, currency (gains) losses, net, litigation matters and all other expenses, net. Free Cash Flow is defined as cash flow from operating activities as reported on the Consolidated statement of cash flows, less cost of additions to land, buildings and equipment and cost of additions to internal use software plus proceeds from sales of land, building and equipment. Additional information regarding long-term incentives can be found under “2017 Compensation for the Named Executive Officers—Long-Term Incentives.”

Strategic Initiative Grants

In 2017, in light of the significant challenges facing Conduent following its separation from Xerox Corporation (“Separation”), the Compensation Committee approved a special stock award (“Strategic Initiative Grant” or “SIG”) for each of the named executive officers. The key program objectives are to strengthen the alignment of management with shareholders, accelerate the growth of stock ownership levels among the new executive officer team, motivate and promote the successful and expedited business turn around, facilitate cultural change and talent upgrade and retain key executives. The SIG was granted in 50% performance based awards (performance shares) and 50% time based awards (restricted shares). As noted above under “Long-Term Incentives”, this approach balances the need to motivate and drive future behavior while being retentive and fostering stock ownership. The performance shares include two cost transformation and two client outcome metrics, all equally weighted. These measures are: Cost Transformation – Information Technology (25%), Cost Transformation – Real Estate, General & Administrative (25%), Service Line Penetration (25%), and New Business Signing growth (25%). Many of the terms and conditions of the SIG are the same as our ELTIP. For additional information regarding these awards, see the “Long-Term Incentives - Strategic Initiative Grants” section of the CD&A.

PROCESS FOR DETERMINING COMPENSATION

Role of the Compensation Committee

The Compensation Committee administers the executive compensation program for our named executive officers on behalf of our Board

of Directors and shareholders.

The members of the Compensation Committee are Paul Galant, Joie A. Gregor and Courtney Mather. All members of the Compensation Committee are independent directors in accordance with applicable

NYSESEC and Nasdaq standards, including heightened independence requirements for Compensation Committee members. The

biographies of the Compensation Committee members appear beginning on page 7 of this Proxy Statement.The Compensation Committee has the authority to retain, and did retain for 2017, an independent advisor for the purpose of reviewing and providing guidance related to executive compensation programs. The Compensation Committee’s responsibilities are discussed beginning on page 1518 of this Proxy Statement. A complete description of the Compensation Committee’s responsibilities and functions appears in its charter, which can be found on our website atwww.conduent.com/corporate-governance.

The Compensation Committee evaluates many factors when designing and establishing the executive compensation plansprogram and targets.specific goals and pay levels. In determining the appropriate compensation levels, the Compensation Committee considers the scope and impact of the executive’s role within the organization, experience, sustained performance and future potential. The Compensation Committee also reviews the compensation levels of similarly positioned executives at peer companies, general industry compensation data and internal pay considerations.

The Compensation Committee retains an independent consultant for the purpose of providing market data and guidance related to executive compensation programs.

While the Compensation Committee is ultimately responsible for making all compensation decisions affecting compensation of our named executive officers, the CEO participates in the process by:

•Periodically discussing with the Compensation Committee the performance of the Company and each executive officer.officer with the Compensation Committee; and

•Making recommendations on the components of compensation for the other executive officers.

After receiving input from the CEO, the Compensation Committee makes its own assessments and formulates compensation amounts for each of our

executive officers, including our named executive officers, ensuring that the total

target compensation for each is appropriate and competitive.

Role of the Independent Consultant

The Compensation Committee has retained the services of an independent compensation consulting firm, Frederic W. Cook & Co., Inc. (the “Consultant(“FW Cook”), to assist with its responsibilities. The ConsultantFW Cook reports only to the Compensation Committee and has not performed any other work for Conduent since being retained as an independent consultant to the Compensation Committee, except in its capacity as an independent advisor to the Corporate Governance Committee on non-employee director compensation matters. As provided in its charter, the Compensation Committee has the authority to determine the scope of the Consultant’sFW Cook’s services and may terminate the Consultant’sFW Cook’s engagement at any time. The Compensation Committee evaluated the independence of FW Cook and concluded that no conflict of interest existed that would prevent FW Cook from independently advising the Compensation Committee.

During

2017, the Consultant2023, FW Cook provided the following services:

•regularly updated the Compensation Committee on trends in executive compensation, including providing proactive advice on emerging trends and best practices;

•reviewed officer compensation levels and overall performance compared to general industry survey data and a peer group made up of organizations with which Conduent is likely to compete for executive expertise,business, investor capital and/or share with Conduent a similar business model in one or more areas;executive talent;

•reviewed incentive compensation designs for short-term and long-term programs;

•advised the Compensation Committee on executive compensation peer group companies for pay and performance comparisons;group;

•reviewed the Compensation Discussion and Analysis and related compensation tables for the proxy statement on Schedule 14A, filed with the SEC;inclusion in this Proxy Statement;

reviewed Compensation Committee meeting materials with management before distribution;

•attended Compensation Committee meetings, including meetings in executive session, as requested by the Compensation Committee chair;

•offered independent analysis and input on CEO compensation;

•assisted with non-employee director compensation; and

advised on post Separation related•reviewed the compensation actions.risk assessment.

Peer Group

In 2017, the Compensation Committee approved a peer group of companies with whom Conduent competes for business, investor capital and executive talent. The Committee determined that the identified peer group companies are reasonably similar to Conduent in terms of industry profile, size, and market capitalization.

The 2017 peer group consisted of the following companies:

| | | | |

ADP

| | CGI Group Inc.

| | Genpact

|

Aon

| | Cognizant Tech Solutions

| | MAXIMUS

|

CACI International

| | DXC Technology

| | Paychex

|

Cerner Corp | | Convergys | | IQVIA

|

The peer group is reviewed annually and isConduent’s 2022-2023 Peer Group was used to benchmark 2022 compensation and assist in setting 2023 compensation for our named executive officers, as well as forto review general pay practices and trends.

trends at that time. Additionally, this peer group is used to determine Total Shareholder Return performance for our 2023 PRSU—rTSR awards. The Compensation Committee reviewed the 2022-2023 peer group on August 23, 2022, and believes Conduent’s peers focus on key business competitors, as well as companies that align with Conduent’s size, scope, and competitors for executive talent and investor capital. Further, Conduent’s revenue at that time, ranked near the median of the peer group:

| | | | | | | | |

| 2022 / 2023 Peer Group | |

| | |

| Alight (ALIT) | ICF Intl (ICFI) | |

| | |

| CACI International Inc (CACI) | Leidos Holdings, Inc (LDOS) | |

| | |

| CGI Group (GIB) | ManTech Intl* | |

| | |

| Concentrix (CNXC) | Maximus, Inc (MMS) | |

| | |

| CSG Systems Intl (CSGS) | TELUS Intl (TIXT) | |

| | |

| ExlService (EXLS) | TriNet Group (TNET) | |

| | |

| Genpact LTD (G) | Veradigm (MDRX) | |

| | |

|

| |

| *ManTech Intl was acquired in 2022 and thus removed from the group for 2023-2024 | |

The current peer group has remained consistent with the 2022-2023 peer group, with the exception of one company, ManTech Intl. Conduent’s resulting 2023-2024 Peer Group was used to benchmark 2023 compensation and assist in setting 2024 compensation for our named executive officers, as well as to review general pay practices and trends at that time.

Competitive Market Information

In 2017,

At the end of 2022, the Compensation Committee

receivedreviewed a report comparing the compensation of its named executive officers with the compensation of

executives in comparable

positions at our peer group

named executive officerscompanies based on the most recent proxy filings (primarily used for the CEO, CFO and General Counsel) as well as general industry survey data to

recognizesupplement the

limitations ofpeer group proxy

data (Willis Tower’s Watson CDB General Industry Executive Compensation survey).data. This comparison included compensation data for these elements of pay:

•base salary;

•target short-term incentives;

•total target cash compensation (base salary plus target short-term incentives);

•target long-term incentives; and

•total target direct compensation (total target cash compensation plus target long-term incentives).

The competitive market data iswas prepared, analyzed, and presented to the Compensation Committee by the Committee’s Consultant.FW Cook. The market pay range is viewed by the Compensation Committee as a competitive reference point, but that data is not used to match a specific percentile of the market. Emphasis is placed on total target pay. In 2017,direct compensation. For 2023, the Compensation Committee reviewed total target totaldirect compensation (excluding the Strategic Initiative Grants) against the market data using the 50th percentile as a reference point. The Compensation Committee exercises discretionjudgement in setting individual compensation levels to reflect an assessment of the executive’s impactexperience, responsibilities and expected contributions to Conduent, as well as potential for advancement.2017 COMPENSATION FOR THE NAMED EXECUTIVE OFFICERS

2017

2023 Compensation for the Named Executive Officers

2023 Total

TargetDirect Compensation

Total target compensation includes base salary, target annual short-term cash incentive and target annual long-term equity incentive awards, which includes the April 1, 2017 ELTIP grants and excludes the special Strategic Initiative Grant. Targets

The majority of our named executive officer payofficers’ compensation is provided under our variable incentive compensation programs. Variable pay increases with responsibility while long-term incentive compensation represents the greatest component of pay. The 20172023 total targetdirect compensation which includes annual base salary, target short-term incentive compensation as a percentagetargets of base salary and target long-term incentive compensationour named executive officers can be found under the heading “Executive Summary—2017“Our Executive Compensation Program—2023 Total Direct

Compensation Targets for Named Executive

Officers.”Officers” For further information regarding the process the Compensation Committee used to determine compensation for our named executive officers, please see

above under “Process for Determining

Compensation”.Compensation.”

More complete compensation information appears in the “Summary Compensation Table” on page

37.43.

Base salary is the fixed pay element of our compensation program that reflects the level and scope of responsibility within the Company. The Compensation Committee reviews each named executive officer’s base salary annually as well as in connection with a promotion or other change in responsibility. In connection with the promotion of Jeffrey Friedel to Chief People Officer, his base salary was increased from $285,000 to $425,000, effective February 1, 2017. The table below reflects base salaries for our named executive officers as of December 31, 2022 and December 31, 2023.

| | | | | | | | |

| Executive | Annual Base Salary at 12/31/22 | Annual Base Salary at 12/31/23 |

| Clifford Skelton | $835,000 | $835,000 |

| Stephen Wood | $525,000 | $525,000 |

| Michael Krawitz | $500,000 | $500,000 |

| Mark Prout | $450,000 | $450,000 |

| Randall King | $450,000 | $450,000 |

| Mark King | $425,000 | $450,000 |

The base pay increase for Mr. Mark King was made to better align base pay with internal and external peers. No other named executive officers were unchangedreceived a base salary increase from 2016.2022 to 2023.

The Annual Performance Incentive Plan

(“APIP”) provides for short-term incentive awards that reward performance against our annual operating plan, paid in the form of cash to our named executive officers and other eligible

employees.associates. Each year, the Compensation Committee

determinesreviews the target short-term incentive award opportunity, scaled to the executive’s level of responsibility, and stated as a percentage of base salary, and the maximum payout opportunity.

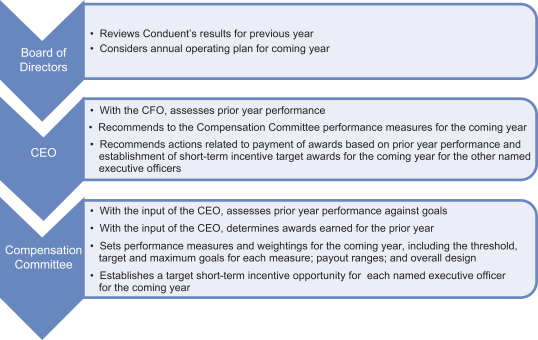

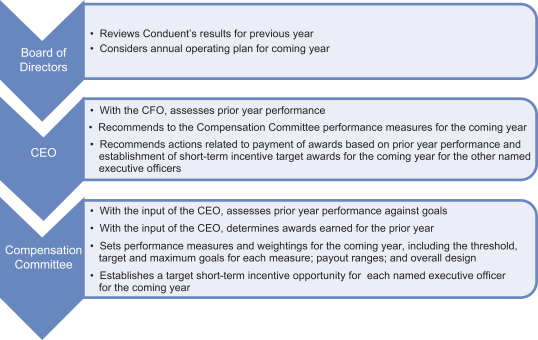

The following chart reflects Conduent’s process for setting short-term incentive awards. This process typically takes place in the first quarter of the year.

Short-Term Incentive Target Award Opportunity for the

Individual Named Executive Officers

The annual short-term incentive target award opportunity for each of our named executive officers takes

into account many factors

into consideration, including scope of responsibility,

past contributions, expected

future contributions, internal pay equity and competitive executive compensation practices. If an executive’s

role or responsibilities change after the terms of the award are approved, the Compensation Committee

is permitted tomay adjust the short-term incentive target award opportunity at that time.

The

2017table below depicts the APIP

target award opportunity was approved by the Compensation Committee at 150% of base salarytargets for

Mr. Vemuri and 75% of base salary for the other named executive officers. Mr. Friedel’s APIP target opportunity was increased to 75% from 50%, effective February 1, 2017, to reflect his promotion to Chief People Officer.Short-Term Incentive Performance Measures

Short-term incentive awards (APIP)2023 for our named executive officersofficers. No increases were intendedmade to qualify as “performance-based compensation” under Section 162(m) of the Internal Revenue Code. short-term incentive target percentages from 2022 to 2023.

| | | | | |

| Executive | Target Short-Term Incentive (% of Base Salary) |

| Clifford Skelton | 150 | % |

| Stephen Wood | 80 | % |

| Michael Krawitz | 75 | % |

| Mark Prout | 75 | % |

| Randall King | 75 | % |

| Mark King | 75 | % |

Short-Term Incentive Performance Measures

The Compensation Committee established maximum payout opportunities under the Short-Term Incentive Pool (“STI Pool”). EachAPIP for 2023 pursuant to which each named executive officer is covered under the STI Pool,eligible to receive an incentive payout, assuming Conduent attains certain pre-established performance goals. In 2017, while2023, the performance goalgoals for the STI Pool wasAPIP were designed to align with Conduent’s overall strategies, goals and objectives. Our 2023 performance measures were based on achievementRevenue (adjusted for currency), Adjusted EBITDAMargin and Net Annual Recurring Revenue (“Net ARR”) Activity. The target for Revenue was lower than our 2022 target and actual results, due to business runoff from prior years and the anticipated reduced impact of positive government stimulus payments in 2023. The defined APIP measures were designed to give a clear line of sight to key business results and to encourage growth in revenue without eroding margin.

Our targets were consistent with our overall budget for the year, as well as guidance to investors. The Compensation Committee did not amend the goals under the APIP for 2023 or exercise discretion to increase or decrease funding under the APIP. The 2023 APIP plan focuses on Conduent’s growth and efficiency goals, while additional consideration was given to our quality goals, and is in alignment with our business strategy. Our defined APIP metrics were measured as follows:

•Adjusted Revenue (40% weight)

•Adjusted EBITDA with achievement of the performance threshold resulting in funding of the STI Pool at maximum, subject to the Compensation Committee’s negative discretion, the amount of each named executive officer’s actual bonus was determined based on the achievement of the applicable performance metrics, which may result in actual payouts less than the named executive officer’s allocation under the STI Pool. For this purpose, Adjusted EBITDA represents income (loss) before interest, income taxes, depreciation andMargin (40% weight)

amortization adjusted for Restructuring and related costs, Separation costs, Other (income) expenses, net, NY MMIS, Health Enterprise charge (HE charge) and (Gain) loss on sale of asset and business. After certifying that Conduent had achieved positive Adjusted EBITDA and that the STI Pool was fully funded, the Compensation Committee exercised its discretion and reduced the short-term incentive award amounts payable and approved the payouts as described•Net ARR Activity (20% weight)

(Please see “Definitions” on page

29.Results51 of financial performance may be adjusted plus or minus 20% on a discretionary basis to recognize individual performance, but in no event would anthis Proxy Statement for full definitions.)

The APIP payout exceed the maximum payout target (200%). Payoutfunding level for achieving threshold performance is 50%, payout25% of target. The APIP funding level for achieving target performance is 100% of target, and payoutthe APIP funding level for achieving maximum performance is 150% of target, while the over-achievement funding for Adjusted Revenue and Adjusted EBITDA Margin is 200%. Performance below threshold results in zero APIP funding. Performance results and payoutsAPIP funding levels are interpolated between these points. There is no required payoutThe following table notes the 2023 Threshold, Target, Maximum and Over-achievement APIP targets for businessour APIP Goals:

| | | | | | | | | | | | | | |

Performance Measure(1) | Threshold

25% Funding | Target

100% Funding | Maximum

150% Funding | Over-Achievement

200% Funding |

Adjusted Revenue(2) | $ | 3,662 | M | $ | 3,775 | M | $ | 3,888 | M | $4,153M |

| Adjusted EBITDA Margin | 9.90 | % | 10.40 | % | 10.90 | % | 11.40 | % |

| Net ARR Activity | $ | 141 | M | $ | 166 | M | $ | 191 | M | NA |

Our overall 2023 APIP performance

below threshold levels.The measures, weightings, goals and target and maximum payout ranges set by the Compensation Committee for 2017 werewas measured as follows:

| | | | | | |

Performance Measure | | Weighting | | Target

(100% payout) | | Maximum

(200% payout) |

Adjusted EBITDA

| | 60% | | $672 million | | $ 690 million |

Revenue Growth (at constant currency)

| | 30% | | $6,152 million | | $6,190 million |

Revenue Productivity (per employee)

| | 10% | | Increase of

$500/employee | | Increase of

$1,000/employee |

These

| | | | | | | | | | | | | | |

Performance Measure(1) | Weighting

(A) | Actual

Results | Performance

Achievement

(B) | Funding

%

(A) x (B) |

Adjusted Revenue(2) | 40% | $ | 3,722 | M | 65 | % | 26 | % |

| Adjusted EBITDA Margin | 40% | 10.20 | % | 63 | % | 25 | % |

| Net ARR Activity ($M) | 20% | $ | 62 | M | Below Threshold | 0 | % |

| Total | | | | 51 | % |

| Actual Funding | | | | 51 | % |

____________________

(1)The performance goals were aligned with Conduent’s 20172023 operating plan at the time they were established and designed to be challenging yet achievable.

(2)Revenue was adjusted for the impact of divestitures and currency movements from the point at which the targets were set.

Total performance achievement was measured at 51% of target, and this 51% funding level determined the size of the overall pool of funds available for bonuses, while actual bonus payouts were determined on an individual-by-individual basis, based on performance and the overall funding.

Determining Short-Term Incentive Award Payouts

After the end of the fiscal year, the CFO confirms the financial results and communicates the results to the Compensation Committee. Subject to the Compensation Committee’s review and approval, any

extraordinary items or material unusual charges or gains are reviewed with the Compensation Committee for possible impact on APIP

plan calculations.

Each

Results for each performance measure isare assessed and calculated independently. The weighted results of each measure are added together to determine overall performance results. PayoutsFunding levels are made proportionately for achievement at levels between the goals. Even ifIf threshold pre-established performance measures are achieved, the Compensation Committee retains discretion to determine a lesser short-term incentive thanan APIP funding level that differs

from the calculated incentive

payout,funding level, or no

short-term incentiveAPIP funding at all, as it deems appropriate. The Compensation Committee also retains its discretion to increase or decrease an

individual APIP award

(plus or minus 20% as described above) based on individual performance, provided that the named executive officer’s award may never exceed their maximum payout

of 200% of target.

2017

2023 Performance for Short-Term Incentive Award Payouts

Performance

Following the certification of the financial results for

2017 against the APIP performance measures (in millions) were: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Performance

Measures | | Actual | | | Adjust-

ments | | | Adjusted

Results | | | | | | Calculated Factor | | | Weighting | | | Payout

Percentage | |

Adjusted EBITDA | | $ | 672 | | | $ | 6 | | | $ | 678 | | | | | | | | 133 | % | | | 60 | % | | | 80 | % |

Revenue Growth

(at constant currency) | | $ | 6,022 | | | $ | 101 | | | $ | 6,123 | | | | | | | | 77 | % | | | 30 | % | | | 23 | % |

Revenue Productivity

(per employee) | |

| Below

threshold |

| | | n/a | | |

| Below

threshold |

| | | | | | | 0 | % | | | 10 | % | | | 0 | % |

| | | | | | | | Final Calculated Payout -> | | | | 103 | % |

Adjusted EBITDA: $678M, adjusted for the impact of hurricanes on U.S. and Latin America operations, as well as divestures.

Revenue Growth (at constant currency): $6,123M, adjusted for incremental strategic actions, hurricane impact, and translation currency.

Revenue Productivity (per employee): The Company did not achieve its targets on Revenue Productivity due to decisions impacting labor such as insourcing of IT roles, conversion of subcontractors, and shifting headcount to lower cost locations.

Following the CFO certification of performance results for 2017,2023, the Compensation Committee reviewed the calculated payout onachievement of the performance measures under the 2023 APIP. The Committee supported management’s recommendationMr. Skelton received a short-term incentive equal to apply negative discretionthe corporate funding level, based on the mixedresults stated above. The Compensation Committee granted short-term incentive awards differing from the approved funding level for Messrs. Wood, Krawitz, Prout and Randall King to reflect individual contributions and performance results as well asfor the impactexecutive’s function or business unit. Mr. Mark King was not employed with Conduent at the date of adjustments on the calculated payout and approvedthus did not receive an 80% payout factor.APIP payout. Details of the 2023 Target bonus and actual payouts are below:

| | | | | | | | | | | |

| Executive | 2023 | 2023 | 2023 |

Bonus Target

Amount | Actual Bonus

Amount | Actual Bonus

as a % of Target |

| Clifford Skelton | $ | 1,252,500 | | $ | 638,775 | | 51 | % |

| Stephen Wood | $ | 420,000 | | $ | 224,910 | | 54 | % |

| Michael Krawitz | $ | 375,000 | | $ | 200,813 | | 54 | % |

| Mark Prout | $ | 337,500 | | $ | 180,731 | | 54 | % |

| Randall King | $ | 337,500 | | $ | 137,700 | | 41 | % |

| Mark King | $ | 335,856 | | $ | — | | — | % |

The bonus target amount for Mr.

Peffer’s awardMark King was

increasedprorated for the increase in base salary from $425,000 to

90%, reflecting his achievements in standing up Conduent as a new public company. Mr. Amoriell’s award was increased to 90% reflecting his strong performance leading the Public Sector business. Mr. Walsh’s award was increased to 96% reflecting his outstanding performance in the finance transformation, as well as the completion of five divestitures.In view of 2017 results, the Compensation Committee and our CEO believe that the annual short-term incentive payments resulted in reasonable and appropriate performance-related incentive payments to our named executive officers. The annual incentives paid to$450,000, effective February 2, 2023. All other APIP target bonus levels for our named executive officers in March 2018 for 2017 performance are shown in the “Summary Compensation Table.”remained consistent from 2022 to 2023. Additional information about the short-term incentive opportunities is shown in the “Grants of Plan-Based Awards in 2017”2023” table. Information regarding short-term incentive payouts under certain termination events and the amount of the estimated payouts and benefits payable to the named executive officers assuming a change in control of Conduent and a qualifying termination of employment is presented in the “Potential Payments Upon Termination or Change in Control” table.

We provide long-term incentives to reward our named executive officers for sustained performance, as a retention incentive and to align the executive’s interests with shareholders to drive long-term value creation. Awards are intended to encourage a strong ownership stake in the Company to drive superior performance on long-term Company objectives. TheWhen determining long-term incentive awards, the Compensation Committee considers peermarket data, relative impact of the executive’s position, responsibilities and role toat Conduent and each named executive officer’s performance.

During the first fiscal quarter of 2023, the Compensation Committee approved LTIP grants for our named executive officers. As part of this approval, the Compensation Committee established performance

when determining long-term incentive awards.Executive goals and award values and an April 1, 2023 grant date. Additional information regarding the 2023 LTIP awards can be found in the “Summary Compensation Table” and the “Grants of Plan-Based Awards in 2023” table.

Long-Term Incentive Program

and Performance Measures

Long-term incentive awards aregranted on April 1, 2023 were made pursuant to the Conduent Incorporated 2021 Performance Incentive Plan. 50% of the value of each award was granted in the form of Restricted Stock Units; 35% of the value in the form of Performance Restricted Stock Units with Revenue Growth Targets, 2023 PRSU—Revenue Growth; and 15% in the form of Performance Restricted Stock Units with a relative TSR measure compared with our 2022-2023 Peer group, 2023 PRSU—rTSR. Revenue Growth and rTSR were selected as our long-term metrics to emphasize our continued focus on growing revenues and increasing shareholder value.

Restricted Stock Units vest 1/3 each December 31 of 2023, 2024 and 2025, and the number of RSU shares are calculated for each named executive officer by dividing 50% of the approved target long-term incentive award value by the closing price of Conduent Common Stock on the grant effective date. The RSU shares are then rounded down to the nearest whole share.

Our 2023 PRSUs have service condition that require executives to remain with the Company through December 31, 2025. The target number of 2023 PRSU—Revenue Growth shares for our named executive officers was determined by dividing 35% of the approved target long-term incentive award value by the closing

price of Conduent Common Stock on the grant effective date, and then rounding down to the nearest whole share. The target number of 2023 PRSU—rTSR shares granted to each named executive officer was determined by dividing 15% of the named executive officer’s approved long-term incentive award value by the grant date fair value per share, determined using the Monte Carlo simulation. The calculated 2023 PRSU—rTSR shares are then rounded down to the nearest whole share. Both types of 2023 PRSU awards cliff vest on December 31, 2025, and have performance measures tied to three years.

The 2023 PRSU—Revenue Growth targets were established for each calendar year of 2023, 2024 and 2025. The three annual results will be averaged to determine a final payout. The Revenue Growth targets and payout percentages are as follows:

| | | | | | | | | | | | | | |

| Revenue Growth from Previous Year | 2023 | 2024 | 2025 | Payout % |

| Maximum | 0.0% | 5.7% | 6.2% | 200% |

| Target | (2.0)% | 3.2% | 3.2% | 100% |

| Threshold | (4.0)% | 0.7% | 0.2% | 50% |

For our 2023 PRSU—rTSR awards, we measure Conduent’s stock performance relative to our 2022-2023 proxy peer group, established in August 2022. See “Peer Group” section above.

Conduent’s rTSR percentile rank against the 2022-2023 proxy peer group will be measured over a three-year performance period. Performance for each year is measured against pre-established annual goals and the subsequent payout is averaged over the three-year period. The entire award vests atperiod of April 1, 2023 through December 31, 2025. At the end of the three-year performance period the rTSR results will be based on the following payout matrix:

| | | | | |

| Conduent rTSR | Payout % |

| >=75th Percentile | 150% |

| Median | 100% |

| 25th Percentile | 50% |

Linear interpolation will be used for results between points. Final payout is subject to

Compensation Committee certificationa cap of

performance results. Restricted shares are not tied to performance measures100% if Conduent absolute TSR is negative and

vest ratably overthere is a

three-year period. Once vested, performance shares and restricted shares are paid out intotal value cap of six times the

form of shares of Conduent Common Stock. Any dividends during the vesting period will be accrued and paid on vesting in an amount equal to the dividends the executive would have earned from owning the same amount of Conduent Common Stock throughout the vesting period.target value at vest.

Although equity awards generally are granted on a regular annual cycle, the Compensation Committee may grant off-cycle equity awards for special purposes, such as new hire, promotion,hires, promotions, retention and recognition.

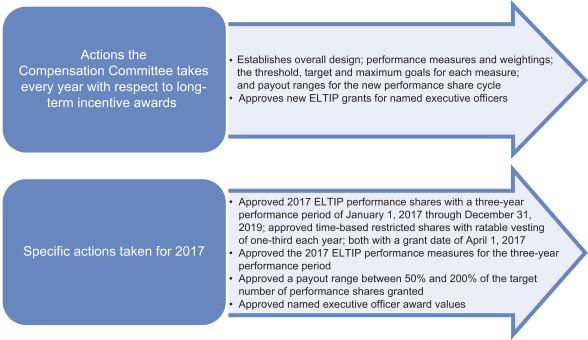

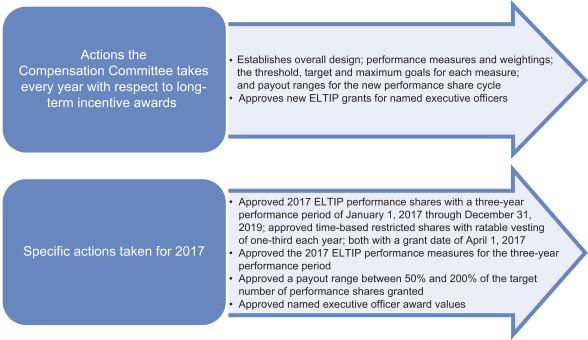

Compensation Committee Actions Relating to ELTIP Awards

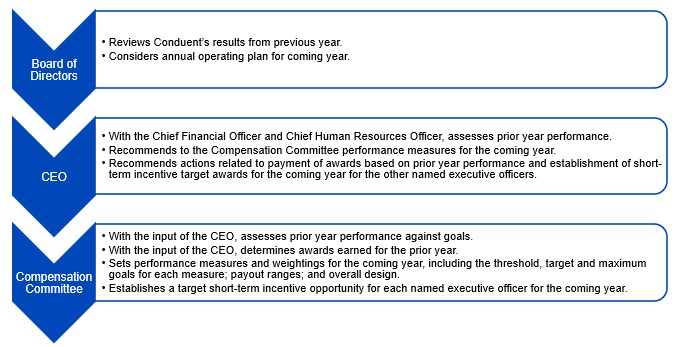

The following chart reflects Conduent’s process for setting long-term incentive awards. This process typically takes place in the first quarter of the year.

During the first fiscal quarter of 2017, the Compensation Committee approved ELTIP grants for our named executive officers, established performance goals and award values, a payout range of 50% to 200% of target, and an April 1, 2017 grant date. Mr. Vemuri’s 2017 ELTIP award was approved as part of his letter agreement as described under “Named Executive Officers with Unique Compensation Arrangements.” The 2017 ELTIP No off-cycle equity awards approved by the Compensation Committee for the other named executive officers are commensurate with their new roles leading Conduent as a standalone public company. Additional information regarding the 2017 ELTIP awards can be found in the “Summary Compensation Table” and the “Grants of Plan-Based Awards in 2017” table.

The 2017 ELTIP award was granted in 50% performance shares and 50% restricted shares. The target number of performance shares and restricted shareswere granted to our named executive officers in April 2017 was determined by dividing2023.

Once vested, all our long-term incentive awards, including RSUs and PRSUs, are paid out in the approved targetform of shares of Conduent Common Stock. Any dividends paid during the vesting period would be accrued and settled at the same time the underlying award vests.

The 2023 Long-Term Incentives provide direct alignment between shareholder value bycreation and earned compensation, and serve to help the Company attract and retain the talent needed to deliver our business strategies.

Looking forward to 2024, our PRSUs will be based 70% on revenue growth and 30% on Conduent’s stock price performance relative to peers with both metrics measured over a 3-year performance period.

Performance Results and Payouts Under Prior Equity Awards

2022 Performance — Restricted Stock Units

The 2022 PRSU—Share Hurdle awards were granted with three share price hurdles that require the average closing price of Conduent Common Stock

to have increased by 15%, 30% or 50% during a consecutive 20-day trading period from the price of Conduent Common Stock on

April 1, 2022, the

long-term incentive grant

effective date.For 2017 restricted shares, one-third vested on 12/31/17, one-third will vest on 12/31/18date, a date consistent with Conduent’s previous granting practices. Price hurdle appreciation levels were set considering the five-year average annual returns of the S&P Small Cap 600 and one-third will vest on 12/31/19. Russell 2000 company indexes

as references, given their average market capitalization and the forecasted growth rates as compared with Conduent.

| | | | | | | | | | | | | | |

| Grant Date Common Stock Price: $5.19 |

| Tranche | Share Hurdle Description | Share

Hurdles | Share Hurdle Achieved as of 12/31/2023 | Service Condition |

| 1 | +15% stock price appreciation | $5.968 | No | December 31, 2022 |

| 2 | +30% stock price appreciation | $6.747 | No | December 31, 2023 |

| 3 | +50% stock price appreciation | $7.785 | No | December 31, 2024 |

The performance period for the 2017 performance shares is 2017 through 2019. PerformancerTSR modifiers for each year (2017, 2018 and 2019) is measuredtranche are based upon Conduent’s percentile rank against pre-established annual goals and the subsequent payout is averaged over the three-year period. The entire award does not vest until the end of the three-year performance period on2021-2022 proxy peer group, as follows:

| | | | | |

| rTSR Percentile | Modifier |

| 75th percentile or above | 105% |

| Median | 100% |

| 25th Percentile | 95% |

Results in between modifier categories are interpolated. All shares remain eligible for vesting for active associates, if share price hurdles are met by December 31,

2019 with payout in the first quarter of 2020, following Compensation Committee certification of the2024. The individual performance

results.The payout for achieving threshold performance is 50%, the payout for achieving target performance is 100%,periods and the payout for achieving maximum performance is 200%. Payouts are made proportionately for achievement at levels between these goals. There is no payout if performance falls below each of the threshold goals established by the Compensation Committee.

| | | | | | | | |

| | | | | Payout Range |

| Performance Measures | | Weighting | | Threshold | | Target | | Maximum |

Adjusted PBT | | 50% | | 50% | | 100% | | 200% |

Free Cash Flow | | 50% | | 50% | | 100% | | 200% |

The performance goals were aligned with Conduent’s 2017 three-year financial model at the time the goals were established. Target performance levels are challenging but achievable with a level of performance that is in line with the Board-approved operating plan, whereas maximum performance levels represent stretch goals which can only be achieved with exceptional performance.

The performance goals and results for the first year (2017)tranche rTSR modifier at the completion of the 2017-2019 ELTIP Plan (in millions) were:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance Measures | | Target | | | Actual | | | Adjust-

ments | | | Adjusted

Results | | | | | Calculated

Factor | | | Weighting | | | Payout

Percentage | |

Adjusted PBT | | $ | 236 | | | $ | 281 | | | | — | | | $ | 281 | | | | | | 200 | % | | | 50 | % | | | 100 | % |